See This Report about Two Different Types Of Bankruptcies And How To Navigate

Table of ContentsBankruptcy Lawyer Near Me Fundamentals ExplainedAbout Every Type Of Bankruptcy ExplainedThe Main Principles Of Bankruptcy Lawyer Camp Hill Some Ideas on Best Bankruptcy Attorneys Near Me You Should Know

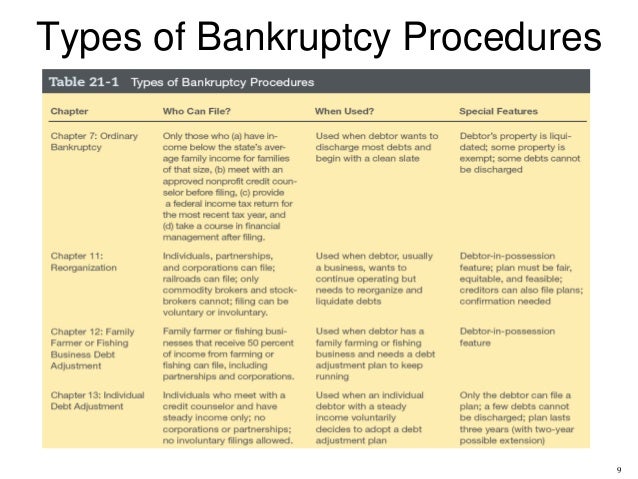

In a Phase 11 personal bankruptcy filing, the debtor remains to operate, keeps ownership of all assets, as well as attempts to work out a reorganization plan to pay off financial institutions. In the past, a business had an almost unlimited amount of time to come up with their reconstruction as well as layaway plan - bankruptcy attorney near me. The Personal Bankruptcy Abuse Avoidance and Customer Defense Act of 2005 enforces a 120-day time frame.Chapter 12 is especially for ranch proprietors. The borrower still owns and regulates his properties and also exercises a repayment strategy with the financial institutions. Phase 13 resembles Chapter 11, however for individuals. The debtor preserves control and also possession of possessions. He additionally exercises a three to five-year payment strategy.

There are also restricts on the amount of financial debt involved. Last but not least, right here are a few vital insolvency terms you'll desire to familiarize on your own with: Financial debt change - The setups created the payment or satisfaction of debts in an amount or fashion that differs from the initial arrangementsDischargeable debts - Financial debts that can be erased by experiencing bankruptcyNondischargeable financial obligations - Financial debts that can not be removed by applying for bankruptcyLien - A cost or encumbrance upon residential or commercial property for the fulfillment of a financial debt or various other dutySecured financial obligation - A debt on which a lender has a lienUnsecured financial debt - A financial obligation that is not tied to any type of product of property.

There are also restricts on the amount of financial debt involved. Last but not least, right here are a few vital insolvency terms you'll desire to familiarize on your own with: Financial debt change - The setups created the payment or satisfaction of debts in an amount or fashion that differs from the initial arrangementsDischargeable debts - Financial debts that can be erased by experiencing bankruptcyNondischargeable financial obligations - Financial debts that can not be removed by applying for bankruptcyLien - A cost or encumbrance upon residential or commercial property for the fulfillment of a financial debt or various other dutySecured financial obligation - A debt on which a lender has a lienUnsecured financial debt - A financial obligation that is not tied to any type of product of property.The Basic Principles Of Bankruptcy: Chapter 7 Vs. Chapter 13

Personal bankruptcy is a lawful process overseen by federal insolvency courts. It's created to assist individuals as well as organisations get rid of all or part of their debt or to aid them repay a part of what they owe. Bankruptcy may aid you obtain relief from your financial obligation, however it's crucial to understand that proclaiming bankruptcy has a severe, long-term impact on your credit scores.

Insolvency can be a complicated process, and the ordinary individual most likely isn't furnished to experience it alone. Dealing with a bankruptcy lawyer can assist ensure your personal bankruptcy goes as smoothly as feasible and also follow all the suitable policies and policies controling bankruptcy process. You'll likewise have to fulfill some requirements before you can file for insolvency.

The therapist will assist you assess your funds, go over possible options to bankruptcy, and also aid you produce a personal budget strategy. If you determine to progress with insolvency process, you'll have to determine which kind you'll file: Phase 7 or Phase 13 - bankruptcy attorney. Both kinds of insolvency can help you eliminate unsecured financial obligation (such as credit score cards), halt a foreclosure or repossession, and quit wage garnishments, utility shut-offs and financial obligation collection actions.

Things about Attorney For Bankruptcy In Camp Hill Pa

Nonetheless, both types of bankruptcy soothe financial obligation in different ways. Phase 7 insolvency, additionally referred to as "straight bankruptcy," is what the majority of people probably think about when they're thinking about declaring bankruptcy. Under this type of insolvency, you'll be called for to allow a federal court trustee to monitor the sale of any properties that aren't excluded (vehicles, job-related tools as well as standard household furnishings might be exempt).

The balance of what you owe is removed after the bankruptcy is released. Phase 7 bankruptcy can not get you out of certain sort of financial obligations - bankruptcy attorney near me. You'll still have to pay court-ordered alimony and also child support, taxes, and also pupil car loans. The effects of a Chapter 7 insolvency are substantial: you will likely lose home, as well as the unfavorable insolvency information will continue to bankruptcy attorney near me be on your credit scores check my blog report for ten years after the declaring date.

The balance of what you owe is removed after the bankruptcy is released. Phase 7 bankruptcy can not get you out of certain sort of financial obligations - bankruptcy attorney near me. You'll still have to pay court-ordered alimony and also child support, taxes, and also pupil car loans. The effects of a Chapter 7 insolvency are substantial: you will likely lose home, as well as the unfavorable insolvency information will continue to bankruptcy attorney near me be on your credit scores check my blog report for ten years after the declaring date.Phase 13 personal bankruptcy works somewhat in different ways, enabling you to maintain your residential property in exchange for partially or completely settling your financial obligation. The insolvency court and your lawyer will work out a 3- to five-year repayment plan. Depending on what's bargained, you may accept pay off all or part of your debt during that time period.

Little Known Facts About Bankruptcy Attorney Near Me.

While any kind of insolvency adversely affects your credit, a Phase 13 might be a more favorable alternative. Since you pay back some (or all) of your financial obligation, you might have the ability to retain some assets. What's more, a Chapter 13 personal bankruptcy will certainly cycle off your credit record after seven years, and also you could file once more under this chapter in just two years.

Right here are a few of the most common as well as important ones:: This is the person or corporation, selected by the personal bankruptcy court, to act on part of the lenders. He or she assesses the debtor's request, sells off property under Chapter 7 filings, and distributes the earnings to creditors. In Chapter 13 filings, the trustee additionally looks after the debtor's repayment plan, obtains repayments from the borrower and also pays out the cash to creditors.

When you've filed, you'll likewise be needed to complete a course in personal financial management before the insolvency can be released. Under certain scenarios, both needs can be waived.: When personal bankruptcy proceedings are full, the bankruptcy is thought about "discharged." Under Phase 7, this happens after your possessions have been offered and creditors paid.